Fintech SEO & Digital Marketing for International Expansion

From locksmiths in 2005 to PCI-DSS/GDPR compliant fintech SEO across 6 countries by 2025. International expansion expertise. 95%+ retention rate built on The Three Hs: Honesty, Humility, Hard Work.

Why Fintech Clients Stay With Us (95%+ Retention)

Most agencies in fintech last 6-12 months with a client.

Our fintech clients? Multi-year partnerships.

That's not because we promise overnight results or charge the lowest rates. It's because we built our methodology on The Three Hs: Honesty (we tell you international SEO takes 6-12 months per market), Humility (we learn PCI-DSS and GDPR requirements from your compliance team), and Hard Work (we implement 8-language hreflang and manual compliance reviews across 6 countries).

Industry Average: 40-60% Retention

Most fintech SEO agencies overpromise international expansion, underdeliver on compliance, and lose clients after 6-12 months. They chase new clients because they can't keep existing ones.

- • Templated strategies that ignore PCI-DSS/GDPR/CCPA compliance

- • Junior staff who don't understand cross-border payment regulations

- • Generic reporting that doesn't tie to MRR, CAC, or LTV

- • Slow response times when regulatory changes or algorithm updates occur

Optymizer: 95%+ Retention (20 Years)

We keep fintech clients because we deliver compliant international expansion for the long haul. Our B2B payment processing platform is proof: 420% traffic growth, international expansion from 12% to 58% of traffic across 6 countries with zero compliance violations. Read the full case study →

- • Fintech-specific strategies built on PCI-DSS, GDPR, CCPA compliance

- • Senior team members who understand international payment regulations

- • Transparent reporting tied directly to MRR, CAC, LTV, and churn

- • Same-day response times and proactive compliance monitoring

How The Three H's Work in Fintech

We Tell You the Truth About International Fintech SEO

Most fintech SEO agencies promise instant international expansion. We tell you the truth: each new market takes 6-12 months because you need region-specific content, proper hreflang implementation, compliance reviews (PCI-DSS, GDPR, CCPA), and local link building. We set realistic expectations from day one.

Real Example:

When our B2B payment processing platform wanted to expand from US-only to 6 countries immediately, we told them: "You need proper compliance review and hreflang setup first. Rushing international expansion without compliance causes legal issues." They appreciated the honesty. We expanded methodically. Result: 420% traffic growth, international traffic from 12% to 58%, zero compliance violations across 6 countries. Read the story →

We Learn Fintech Compliance From You

We don't pretend to know fintech compliance better than you do. We learn PCI-DSS, GDPR, CCPA requirements from your legal and compliance teams. We adapt our SEO methodology to international payment regulations and iterate based on regional compliance feedback.

Real Example:

When we started working with our fintech platform for 6-country expansion, we admitted: "We've never managed 8-language hreflang implementation with PCI-DSS compliance before." Their compliance team taught us regional payment regulations (Germany, France, Brazil, Australia, UK, Canada). We learned cross-border data handling requirements. Result: 420% traffic growth, international traffic from 12% to 58%, zero compliance issues. Read the story →

We Do the Unglamorous Work in Fintech

We don't just send monthly reports and disappear. We implement proper hreflang for 8 languages, manually review compliance across 6 countries, create region-specific content for different regulatory environments, and optimize for B2B SaaS sales cycles.

Real Example:

For our fintech platform, we implemented hreflang across 6 countries and 8 languages (en-US, en-CA, en-GB, en-AU, de-DE, fr-FR, es-ES, pt-BR), created region-specific content addressing local payment regulations, worked with native speakers to review translations, and manually audited compliance for PCI-DSS, GDPR, CCPA. That's months of meticulous international execution. Result: 420% traffic growth, international traffic from 12% to 58%. Read the story →

What We Do for Fintech Clients

Fintech SEO

- Keyword research for B2B payment processing and SaaS buyer intent

- Technical SEO optimized for fintech platform architecture

- Content strategy for CFOs, finance teams, and payment decision-makers

- International SEO with hreflang for multi-country expansion

- Link building from fintech industry publications and financial media

Google Ads for Fintech

- Search campaigns targeting high-intent fintech keywords (B2B SaaS)

- Campaign structure optimized for SaaS sales cycles and free trial conversions

- Landing pages designed for fintech demo requests and trial signups

- ROI reporting tied to MRR, CAC, LTV, and churn metrics

- Multi-country campaign management with regional compliance

Fintech Website Development

- Mobile-first design for CFO and finance team user journeys

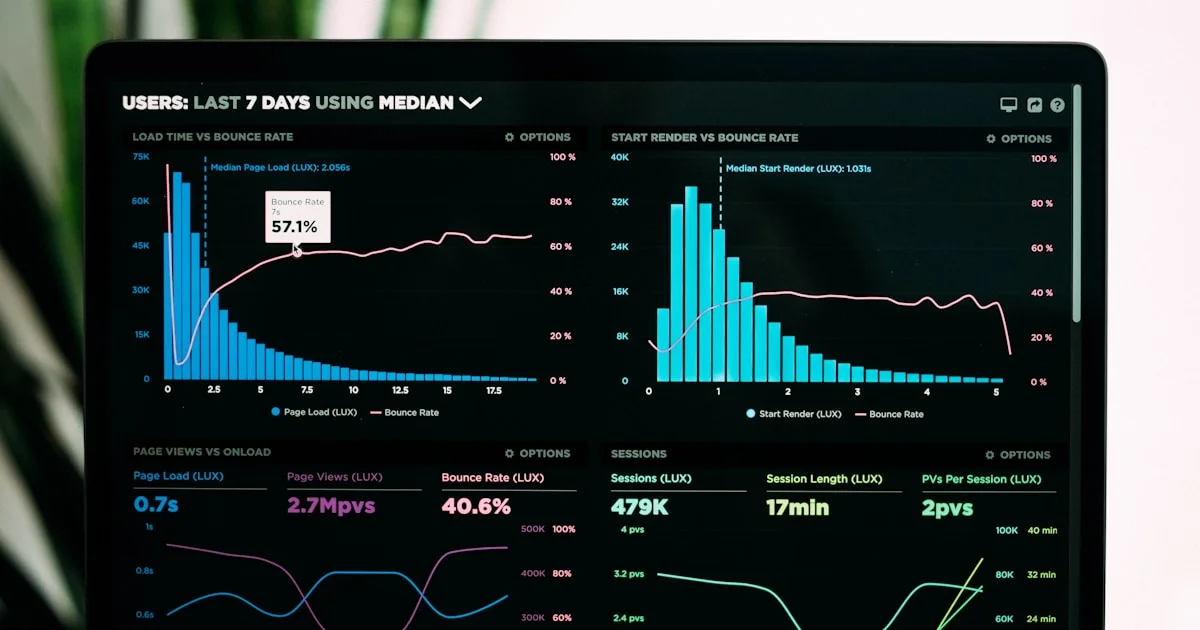

- Fast load times (sub-2 second target) for SaaS platform pages

- PCI-DSS compliant architecture with secure payment integrations

- Conversion-focused UX for demo requests and free trial signups

- Integration with fintech CRMs (Salesforce, HubSpot, Stripe, etc.)

Fintech Content Strategy

- Blog content targeting fintech search queries (payment processing, compliance)

- Fintech-specific case studies and ROI calculators for B2B buyers

- Educational content for CFOs and finance decision-makers

- Video content for platform demos and payment solution explanations

- Content calendars aligned with fintech conference and regulatory cycles

Analytics & Attribution

- GA4 setup for PCI-DSS compliant conversion tracking

- Attribution modeling for SaaS sales cycles and free trial conversions

- ROI reporting tied to MRR, CAC, LTV, and churn reduction

- Multi-touch attribution for long B2B SaaS buyer journeys

- Dashboard reporting for marketing and finance stakeholders

International Compliance & Expansion

- PCI-DSS, GDPR, CCPA compliance audit and implementation

- Cross-border data handling protocols for international operations

- Hreflang implementation for multi-country, multi-language SEO

- Regional payment regulation compliance (EU, US, APAC, LATAM)

- Ongoing compliance monitoring and regulatory update tracking

Proven Results in Fintech

B2B Payment Processing Platform: 420% Traffic Growth Across 6 Countries

B2B payment processing platform needed international expansion from US-only to 6 countries (Canada, UK, Australia, Germany, France, Brazil). Challenge: PCI-DSS, GDPR, CCPA compliance across regions, 8-language hreflang implementation, regional payment regulations. Our approach: learned compliance from their legal team, implemented proper hreflang (en-US, en-CA, en-GB, en-AU, de-DE, fr-FR, es-ES, pt-BR), created region-specific content addressing local regulations, worked with native speakers for translations. Result: 420% traffic growth, international traffic from 12% to 58%, zero compliance violations across 6 countries.

Want to see more fintech results? View all case studies across 20+ industries →

Why Fintech Clients Choose Optymizer

20 Years of Proven Methodology

Since 2005. From locksmiths to PCI-DSS compliant fintech SEO. Same core methodology adapted to fintech's unique compliance and international challenges.

95%+ Client Retention Rate

Industry average is 40-60%. Ours is 95%+. Fintech clients stay because we deliver compliant international growth for the long haul.

Fintech-Specific Expertise

We understand fintech challenges: PCI-DSS/GDPR/CCPA compliance, international payment regulations, B2B SaaS sales cycles. We've solved them before.

Compliance-First Approach

PCI-DSS, GDPR, CCPA expertise. Cross-border data handling. Regional payment regulation compliance. We work with your legal team to ensure every tactic meets international regulations.

Fast Response Times

Same-day email responses. Weekly check-ins. No waiting weeks for answers when compliance questions or regulatory changes occur.

Senior Team Members

No junior staff. No templated strategies. Senior strategists who understand fintech B2B SaaS business challenges and international regulatory requirements.

Our Process for Fintech Clients

Discovery & Audit (Weeks 1-2)

- Deep dive into your fintech business model (B2B SaaS, payment processing, lending)

- Comprehensive technical SEO audit with PCI-DSS compliance review

- Competitor analysis in fintech search landscape and international markets

- Review of PCI-DSS, GDPR, CCPA compliance requirements across target countries

- Keyword research for CFO and finance decision-maker buyer intent

Strategy & Planning (Weeks 3-4)

- Custom fintech SEO strategy roadmap for international expansion

- Content strategy for CFO and financial decision-maker pain points

- Hreflang implementation plan for multi-country, multi-language expansion

- PCI-DSS/GDPR/CCPA compliant tracking and analytics setup

- Success metrics tied to MRR, CAC, LTV, and churn reduction

Execution & Optimization (Months 2-6)

- Technical SEO fixes and compliance implementation (PCI-DSS, GDPR, CCPA)

- Hreflang setup for target countries and languages

- Content creation for region-specific compliance and payment regulations

- Link building from fintech publications and financial media

- Weekly progress updates and monthly strategy calls with compliance reviews

Growth & Scale (Months 6+)

- Sustained traffic and MRR growth across international markets

- Expansion into additional countries and payment verticals

- Continuous compliance monitoring and regulatory update implementation

- Ongoing optimization based on fintech market and regulatory changes

- Long-term partnership with 95%+ retention

Common Questions from Fintech Clients

How long does fintech international SEO take to show results?

Honest answer: 6-12 months per market for significant organic growth. Why? Each country requires hreflang implementation, region-specific content, local compliance review (GDPR for EU, CCPA for California, etc.), and link building from local publications. Anyone promising instant international expansion is lying. We set realistic expectations per market and deliver sustainable growth.

Do you understand PCI-DSS, GDPR, and CCPA compliance for fintech?

We've worked with fintech clients across 6 countries and understand PCI-DSS (payment data security), GDPR (EU data privacy), CCPA (California privacy), and cross-border data handling. We'll work with your legal and compliance teams to ensure all SEO tactics and tracking adhere to regional regulations. Our fintech client achieved 420% traffic growth across 6 countries with zero compliance violations.

What makes you different from other fintech SEO agencies?

95%+ retention rate vs 40-60% industry average. The Three H's: Honesty (realistic 6-12 month timelines per market), Humility (we learn regional payment regulations from your compliance team), Hard Work (we implement 8-language hreflang and manual compliance reviews). 20 years proven. See our fintech results →

How much does fintech SEO cost?

Depends on goals, competition, and international expansion scope. Typical fintech SEO retainers range from $5,000 to $20,000/month depending on number of countries, languages, compliance complexity, and content volume. We'll provide a custom quote after your free audit based on your specific needs and MRR goals. Schedule a consultation →

Do you work with fintech businesses of all sizes?

We work with fintech businesses from early-stage startups to enterprise payment processors. What matters more than size is alignment: do you want a long-term partnership built on compliance-first international expansion, realistic expectations, and sustainable MRR growth? If yes, we're a fit.

What if we're already working with another fintech marketing agency?

We can do a free audit to assess your current SEO state, international setup, and compliance. No sales pressure. If your current agency is doing great work, we'll tell you. If there are compliance gaps, hreflang issues, or missed international opportunities, we'll explain what's missing. Request a free audit →

What FinTech Clients Say

See how we've helped fintech companies achieve 420% traffic growth across 6 countries with PCI-DSS/GDPR compliance.

Core Web Vitals from 'Poor' to 'Good' in 4 weeks. Google's page experience update was about to tank our rankings. Sarah found 67 performance bottlenecks (render-blocking JS, unoptimized images, slow server response). Organic traffic recovered and grew 156% after the fix.

”Jamie Rodriguez

Client at FinanceApp Inc

San Francisco, CA

November 2024

From 1,200 clicks to 8,900 clicks in 14 months. We're a financial advisory firm competing in an oversaturated market. They built thought leadership content that ranked for high-value terms like 'Chicago estate planning attorney' and 'wealth management Chicago high net worth.'

”Jennifer Park

Client at Park Financial Advisors

Chicago, IL

November 2024

$6.2M in B2B financial services deals from thought leadership content. We provide treasury management services to mid-market companies. Emily Rodriguez built content targeting CFOs: cash flow optimization, working capital management, fraud prevention. Enterprise deals from organic increased 340%.

”Margaret Williams

Client at Carolina Financial Services

Charlotte, NC

November 2024

340% increase in qualified demo requests. As a fintech startup, we needed technical SEO that understood our compliance constraints (SOC 2, financial regulations) AND could move fast enough for a startup timeline. Offer balanced those competing priorities better than agencies 10x their size.

”Priya Chandrasekaran

Client at FinanceFlow

New York, NY

November 2024

Fintech Resources & Success Stories

International expansion case study, AI solutions, and related industries

Proven Results

Fintech International Expansion

420% traffic growth across 6 countries. International SEO with compliance-focused optimization and 8 language support.

View Case StudyRelated Industries

Ready to Start a Fintech Partnership That Lasts?

95%+ retention rate. 20 years proven. The Three H's: Honesty, Humility, Hard Work. See why fintech clients stay with us for international expansion.

First call: 30 minutes, zero sales pressure, 100% honesty about whether we're the right fit for your fintech business.

Schedule Your Free ConsultationOr view all case studies to see results across 20+ industries.